Introduction

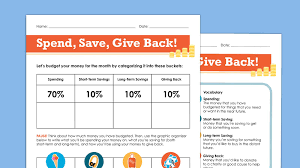

As educators, one of our most critical roles is to prepare our students for real-life situations and decision-making. While math classes often focus on equations and complex concepts, it’s essential to incorporate practical lessons that teach the basics of personal finance. This simple spend, save, and give back lesson plan will help you instill the importance of money management in your students.

Lesson Objectives

1. Understand the role of money in everyday life

2. Learn concepts of spending, saving, and giving

3. Develop smart habits for future financial success

Materials Needed

1. Monopoly money (or printable play money)

2. Three labeled jars or envelopes for each student (Spend, Save, Give Back)

3. Financial scenarios handout

Lesson Overview

Step 1: Introduce the Concepts

Begin by discussing with your students the importance of money management and how it plays a role in their lives. Explain the three basic concepts: spending (purchasing goods and services), saving (setting aside money for future use), and giving back (donating to others or charitable causes).

Step 2: Distribute the Materials

Give each student monopoly or play money along with three jars or envelopes labeled spend, save, and give back.

Step 3: Present Financial Scenarios

Provide the financial scenarios handout to each student or present them one-at-a-time through a projector or whiteboard. These scenarios should include situations where students have to make choices about spending, saving, or giving back – like receiving an allowance, wanting to buy a new toy or item, or deciding to donate to a cause.

Step 4: Decision-Making Process

As you present each scenario, allow students to think about their choices and then prompt them to allocate their play money into the spend, save, or give back jars/envelopes. Encourage discussion and explanation of their reasoning behind each decision.

Step 5: Reflect and Discuss

At the end of the lesson, allow students to compare and contrast their allocated funds in the spend, save, and give back jars/envelopes. Discuss any trends or patterns observed among their choices and how these habits might impact their future financial well-being.

Step 6: Guided Journaling (Optional)

As a follow-up activity, have students write a short reflection in their journals about what they learned during the lesson and how they will apply these money management concepts in real life.

Conclusion

By teaching students about spending, saving, and giving back early on, we are setting them up for a lifetime of financial success and responsible decision-making. Use this easy-to-apply lesson plan as a starting point for introducing essential money management skills in the classroom. With practice and guidance, your students will become confident in making smart financial choices that lead to a stable future.